Mumbai, India: Amidst the cacophony of stock market chatter and the allure of quick wealth, Saurabh Mukherjea is redefining the finance landscape. Whether in corporate meetings, at book releases, participating in television discussions, or engaging on Twitter, Mukherjea’s presence is ubiquitous — and for commendable reasons. His keen insights, investment strategies grounded in data, and steadfast confidence in Indian enterprises are capturing the attention of the financial community.

Interestingly, retail investors are beginning to take notice.

Who is Saurabh Mukherjea, and Why is He Trending?

Mukherjea, the Founder and Chief Investment Officer of Marcellus Investment Managers, has emerged as a prominent advocate for “Clean Investing” in India. Unlike fund managers pursuing fleeting trends, he focuses on established companies, prioritizing long-term success.

Visit Marcellus Investment Managers – Official Website of Saurabh Mukherjea’s FirmWhat is his guiding principle?

“Consistent compounding beats market timing.”

Investors nationwide are increasingly drawn to his strategies, which are backed by a proven track record.

Marcellus Is on Fire: How Mukherjea’s PMS Is Changing the Game

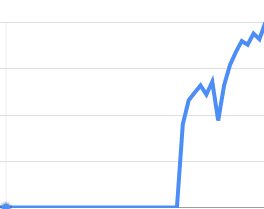

Mukherjea’s premier investment portfolio, known as Consistent Compounders (CCP), has garnered significant attention due to its exceptional performance.

Despite the volatility of the Nifty index in 2024, CCP has demonstrated remarkable stability, consistently achieving double-digit returns. The portfolio features prominent holdings such as:

- ✅ Asian Paints

- ✅ Titan

- ✅ HDFC Bank

- ✅ Page Industries

Importantly, this portfolio does not include any dubious penny stocks or speculative IPOs. Instead, it focuses on companies with sound balance sheets, high returns on capital employed (ROCE), and principled leadership. 💼📊

Bestseller Author + Market Mentor

What is driving the excitement? His best-selling titles consistently dominate the Amazon charts:

- The Unusual Billionaires

- Coffee Can Investing

- Diamonds in the Dust

- The Victory Project

These works transcend typical finance literature; they serve as essential investment guides for Indian audiences.

The Media Darling: Everywhere You Look

Mukherjea is recognized as a leading authority on market analysis across various platforms, including CNBC, ET Now, Moneycontrol, YouTube, and LinkedIn.

His ability to break down budget announcements and elucidate banking crises through engaging memes (adding a touch of humor) resonates with both Generation Z and seasoned investors.

Investors Ask: Is This India’s Warren Buffett(Saurabh Mukherjea)?

This may seem like an exaggeration, but the analogy is quite valid. Similar to Buffett:

- He advocates for long-term investments.

- He steers clear of market speculation.

- He prioritizes investing in companies rather than stock valuations.

- Additionally, he is recognized for his strong ethical principles.

A significant distinction? Mukherjea concentrates solely on India’s domestic leaders, establishing himself as a prominent figure in the nation’s wealth accumulation narrative.

What is the reason for the current excitement (Saurabh Mukherjea)?

- Recent increase in Marcellus PMS inflows — ₹1,200 crore added in the first quarter of 2025.

- Re-launch of Coffee Can Investing featuring revised case studies.

- Workshops aimed at college students and novice investors in Tier 2 and Tier 3 cities.

- Collaborations with fintech companies to integrate his strategies into mutual fund platforms

Investor Insight: What Steps to Take to Emulate His Journey?

If you are unable to invest ₹50 lakhs in Marcellus PMS, there is no need for concern. You can still implement his strategy:

- ✅ Invest in reputable, stable Indian companies

- ✅ Steer clear of stocks with high leverage

- ✅ Focus on businesses that possess competitive advantages

- ✅ Maintain your investment for over 10 years

- ✅ And keep in mind: simplicity can be appealing

Feedback from the Public:

Saurabh Mukherjea possesses an unparalleled clarity in his communication. There are no complicated terms or exaggerations—only straightforward reasoning.

— Rohit, 28, New Investor

“His writings have transformed my perspective on finances. I finally understand investing.”

— Nikita, MBA Student

Final Thoughts: The Individual Transforming Financial Literacy in India

In a society fixated on quick fixes, Mukherjea emphasizes the enduring importance of discipline, ethics, and patience as the true keys to success.

Regardless of whether you are 22 or 52 years old, his message resonates strongly:

“You don’t require 100 stocks. You only need 10 exceptional ones — along with the courage to retain them.”

This is precisely why Saurabh Mukherjea is gaining prominence in India’s financial landscape — not merely as a fund manager, but as a catalyst for change.

Stay informed about India’s investment icons, financial trends, and market strategies by following us. Keep up with MarkupNews — the intersection of finance and clarity.